Digital Budget Accounting System

The world-leading

Digital Budget Accounting System (dBrain+)

The Institute offers an integrated The financial management information system which enables on-line management of the entire process of the dBrain+ and the monitoring of the status of fiscal business in real time basis.

Features of Digital Budget Accounting System (dBrain+)

- Support all fiscal activities and transactions of government finance

- Developed as an all-in-one system for budget formulation, execution, fund management, national property/goods management, and settlement of accounts of the central government.

- Back Up government financial innovation

- Established based on the program budget system to support government financial innovation such as national fiscal management planning, top-down budgeting, and performance management budgeting. Also, prepared financial risk management system by utilizing interconnected management among fund, assets, and debt Furthermore, employs double-entry and accrual-based accounting system to calculate national financial information.

- On-line Real-time Management of Government Finance

- Digitalized the entire process of government financial transactions, and thus enable the comprehension of financial management status in real time basis.

- Produce Government Financial Statistics and Information Analysis

- Provide various and accurate statistical analysis including information on past performance, current status, and forecasts by divisionㆍdepartmentㆍand function. Support proper policy decisions of the government and provide transparent and detailed information on government finance to the general public.

dBrain+ Overview

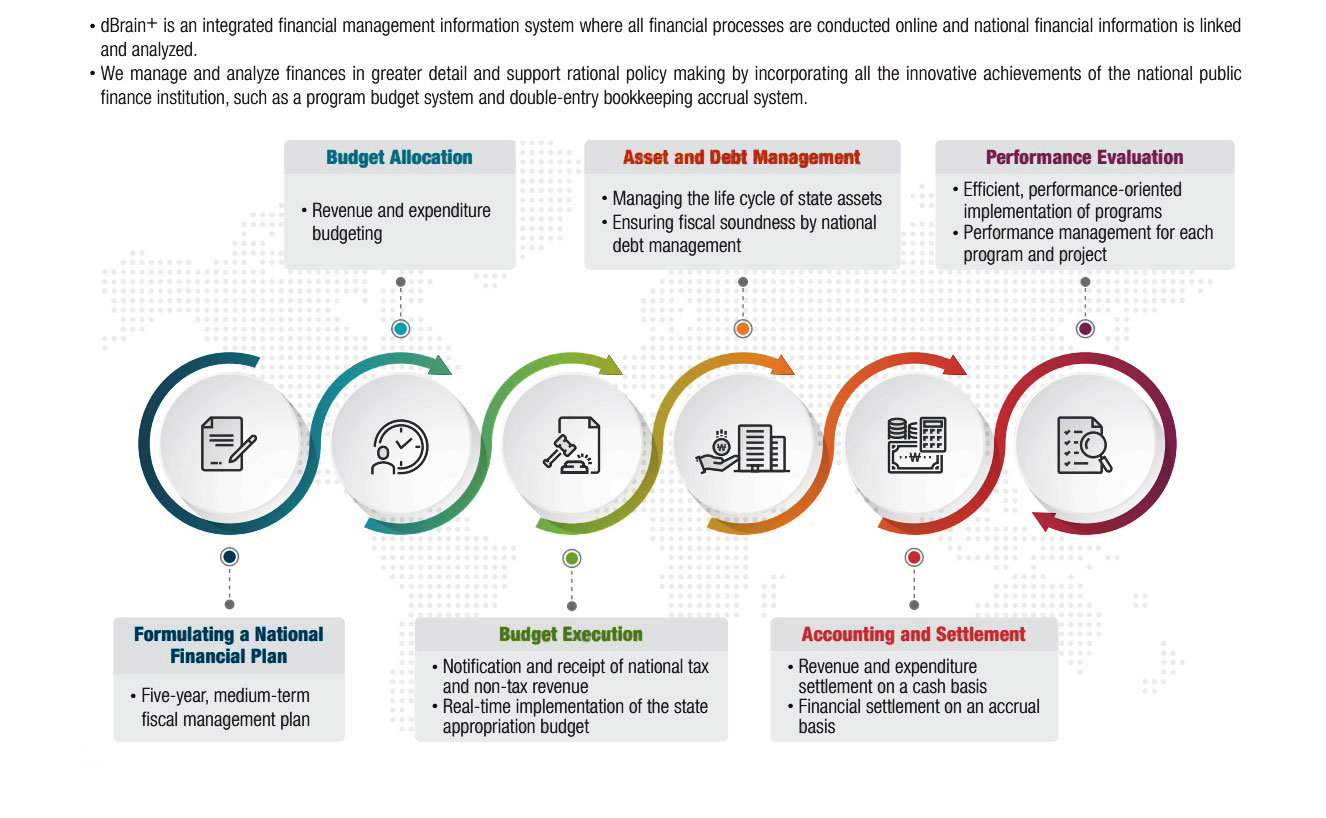

dBrain+ is an integrated financial management information system where all financial processes are conducted online and national financial information is linked and analyzed.

We manage and analyze finances in greater detail and support rational policy making by incorporating all the innovative achievements of the national public finance institution, such as a program budget system and double-entry bookkeeping accrual system.

- Formulating a National Financial Plan

- Five-year, medium-term fiscal management plan

- Budget Allocation

- Revenue and expenditure budgeting

- Budget Execution

- Notification and receipt of national tax and non-tax revenue

- Real-time implementation of the state appropriation budget

- Asset and Debt Management

- Managing the life cycle of state assets

- Ensuring fiscal soundness by national debt management

- Accounting and Settlement

- Revenue and expenditure settlement on a cash basis

- Financial settlement on an accrual basis

- Performance Evaluation

- Efficient, performance-oriented implementation of programs

- Performance management for each program and project